Why Work with Full Service Realtor?

- Realtors carry errors and omissions insurance

- Many agents unfortunately avoid FSBO’s for various reasons. This is a fact which means you are not exposing yourself to everyone on the market. Selling your home is a numbers game. The more people you are exposed to, the faster the sale should occur. If a home sells faster, statistically speaking, it should sell for more money.

- The psychology of the buyer is such that when they make an offer on a property being sold by an owner, they will often make offer lower than market as they believe that you are not paying commission. I have had much experience with this.

- The best time of year to sell is in the spring, as there are more buyers looking at this time. There is also more inventory in the spring, so very important to be marketed well. Below is link to Newsletter showing pricing in Ottawa over past 5 years. Prices typically drop at the end of June.

- Agents should be working with pre-qualified buyers. This should reduce chances of deal falling through due to financing.

- It is true that some people are successful selling on their own, and if it doesn’t work out they often resort to full service. If you need any references of people who were FSBO’s and then decided to list with myself with success I would be happy to provide.

April Newsletter Showing Pricing Trends in Ottawa

Where we have bought and sold homes

Many ask where we do business. Below are two maps. The first map shows properties that we have listed and sold. The second map shows properties we have worked with buyers to help them purchase.

Listed and Sold

Purchased with Buyers

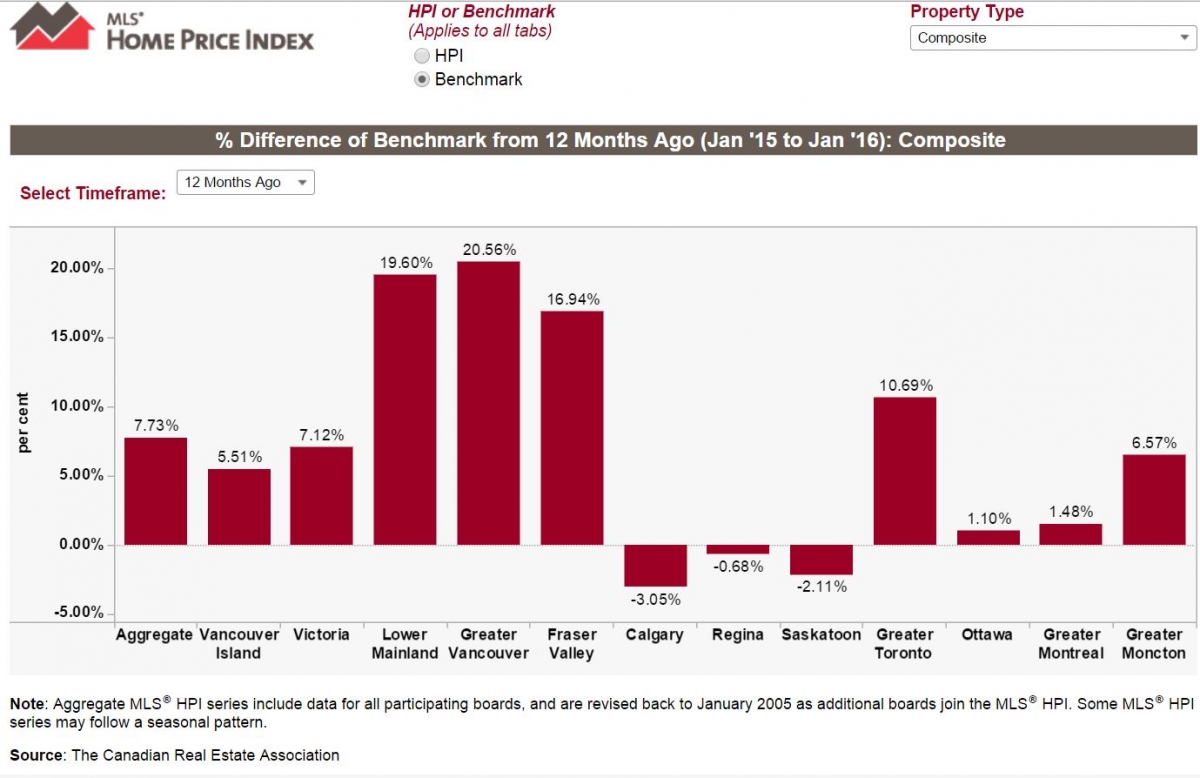

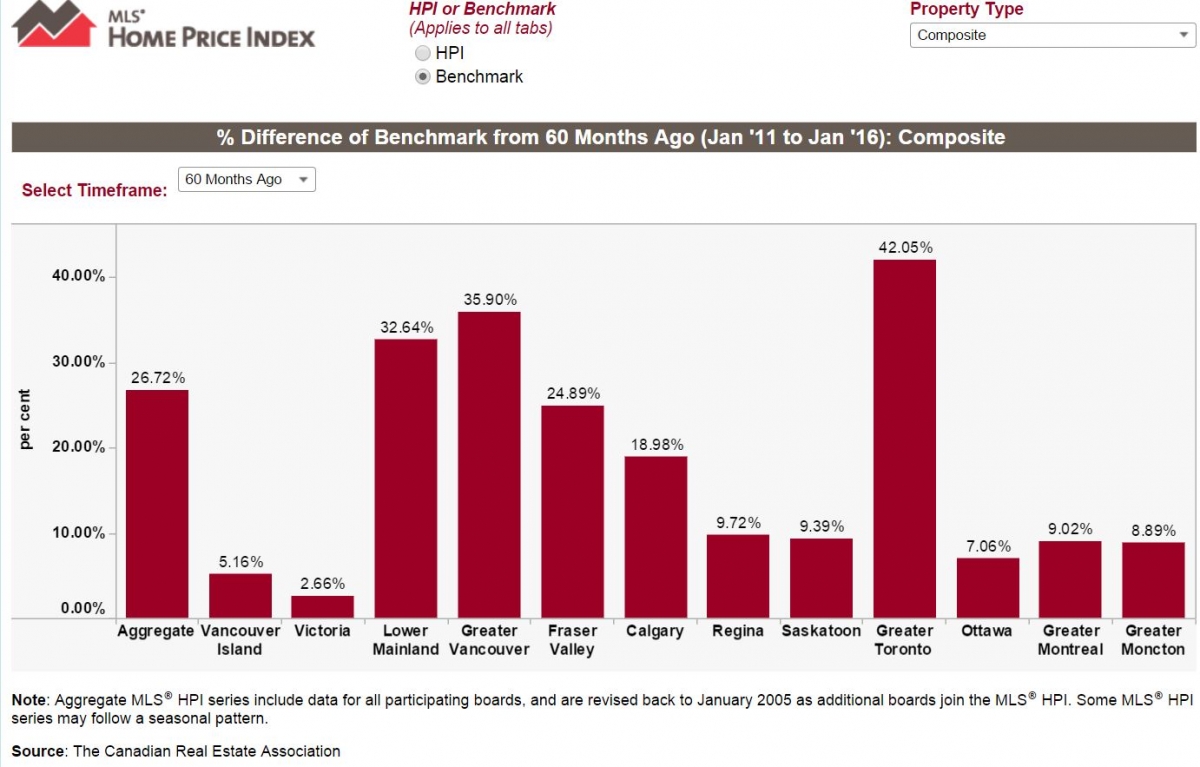

Is the Ottawa Market Overvalued?

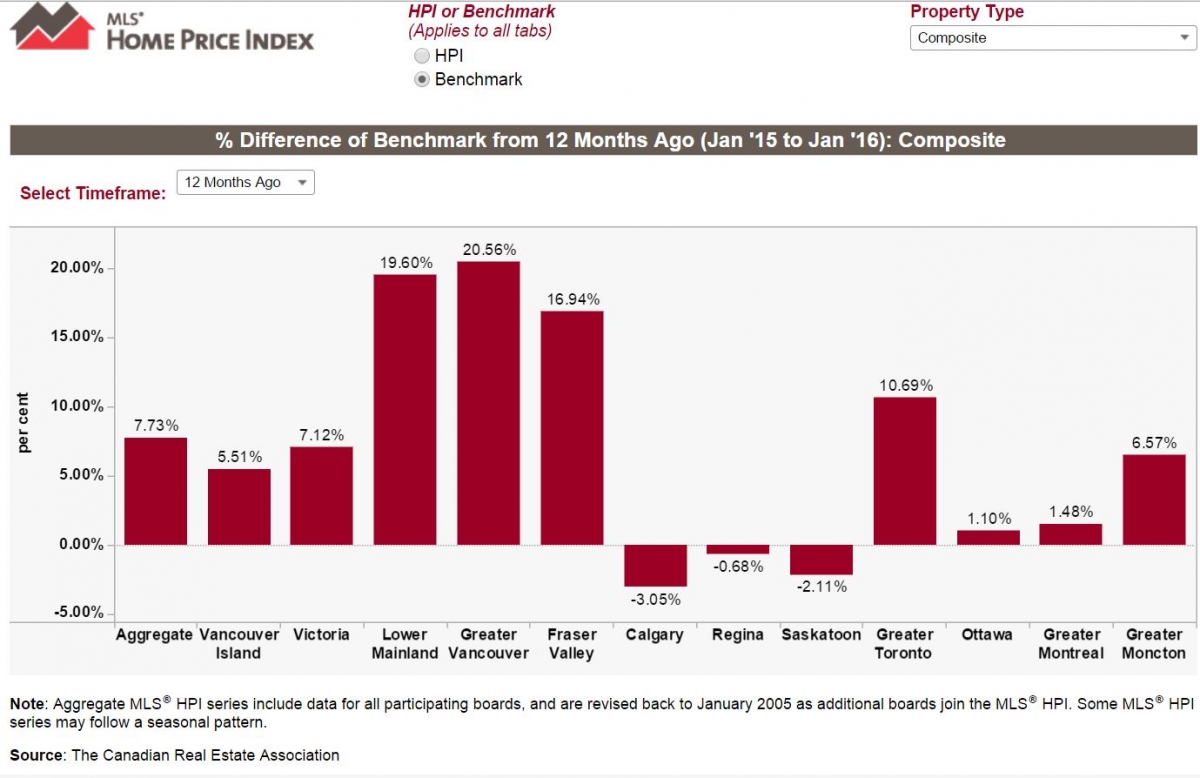

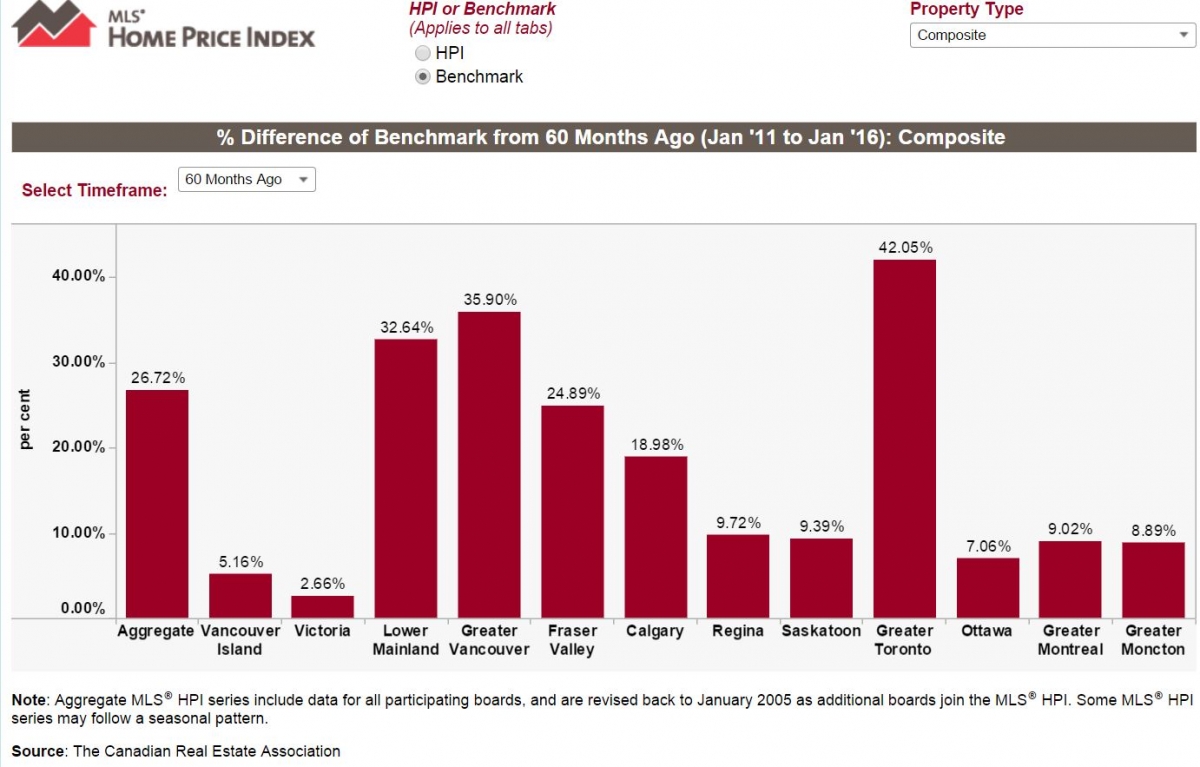

Ottawa folks, when you hear news relating to national real estate trends and you are wondering what is going on, please remember large centers like Vancouver and Tornonto drastically skew the data. Below is a bar chart showing how much homes have appreciated in the last 12 months in various centres in the country. As you can see Ottawa housing prices have only gone up by just over 1%, compared to ~11% for Toronto and ~21% for Vancouver, in the last 12 months. So Ottawites, I would not be too worried about your house losing 30% value overnight when housing prices have only gone up ~7% in the last 5 years in Ottawa (see second bar chart) compared to the 36% and 42% for Greater Vancouver and Toronto respectively.

Monthly Market Update from Power Lyons Real Estate Solutions

Please click on the picture below to view the September Newsletter in high definition PDF format. Also, see what you can buy for $3,000,000. Very nice indeed:)

Power Lyons Real Estate Solutions Latest Market Update

Please click on following picture to view Newsletter in high definition PDF format. This issue has link to FREE HOME SEARCH APP (so easy to use)! Download it and tell me what you think:)

MY FREE HOME SEARCH MOBILE APP – Click to get